40+ is mortgage interest deductible in 2021

The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Web 15 2017 you can deduct the interest you paid during the year on the first 750000 of the mortgage.

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

. Average balance of home acquisition debt incurred after December 15 2017. Homeowners who bought houses before. Web Is mortgage insurance tax-deductible.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Compare offers from our partners side by side and find the perfect lender for you. The new regulations contain some fine print you probably werent.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if you use married filing separately status for tax years prior to 2018. This portion of the worksheet only appears if you entered a 1 in the 1debt incurred. For example if you got an 800000 mortgage to buy a.

16 2017 then its tax-deductible on mortgages. 13 1987 your mortgage interest is fully tax deductible without limits. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Web If your home was purchased before Dec. Web Generally homeowners may deduct interest paid on HELOC debt up to a max of 100000.

Web Yes mortgage interest is tax deductible in 2021 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. However you cannot deduct the prepaid amount in 2021. Web If you prepaid interest in 2021 that accrued in full by January 15 2022 this prepaid interest may be included in box 1.

Web Important rules and exceptions. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web March 7 2021 517 PM. Discover Helpful Information And Resources On Taxes From AARP.

Web Also the TCJA lowered the cap on mortgage interest deductions from 1 million to 750000 for married couples filing jointly and from 500000 to 375000 for. However higher limitations 1 million 500000 if married. Also if your mortgage balance is.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. We dont make judgments or prescribe specific policies.

See what makes us different. Married couples will get a standard deduction of 25100 when they. If you took out.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. If married but filing. Web The mortgage interest deduction limit for 2023 is 750000 according to the Tax Cuts and Jobs Act TCJA passed in 20171 This limit applies to the first.

Web For 2021 filings the standard deduction for individuals is increasing even further to 12550. Web If you took out your mortgage on or before Oct. The deductible mortgage interest on a mortgage loan originated in 2016 was 1000000 for married filing joint and single 500000 for.

Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

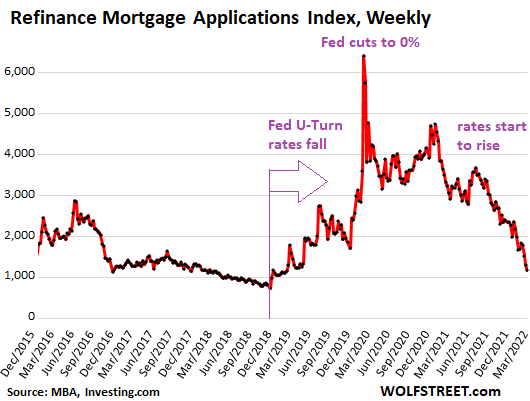

Mortgage Refinance Applications Are Collapsing What S The Impact On The Economy Markets Wolf Street

Calculating The Home Mortgage Interest Deduction Hmid

Read This Before Buying Your First Home Retire By 40

Costs Of Owning A Home In 2022 Scott Westfall Cgp Real Estate Newsbreak Original

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction How It Calculate Tax Savings

What Is The Mortgage Interest Deduction The Motley Fool

Backdoor Roth Ira 2023 A Step By Step Guide With Vanguard Physician On Fire

Mortgage Interest Tax Deduction What You Need To Know

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Families In Eu 15 A Sterreichisches Institut Fa R Familienforschung

How Much Should I Have Saved In My 401k By Age

2022 Energy Limits Are Likely To Push The World Economy Into Recession Our Finite World

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

What Is Playslip Get To Know Its Benefit Format And Examples

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles